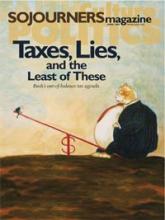

How we distribute the burden of sustaining governments determines in good part who prospers and who does not, who invests and who sinks into debt, who takes from society and who gives. When we decide who, and how, and how much to tax, and how to spread the burden, we shape the kind of nation we are and will become.

The moral philosophers of ancient Athens came to recognize this 2,500 years ago. When Athens was a tyranny it had a flat tax, an onerous burden that fell in the same amount on everyone subject to it. The less one had, the heavier the burden.

The philosophers of the Greek city-state concluded that morally the tax burden was upside down. Those who received the greatest material benefit from being Athenians should bear the greatest burden of maintaining Athens, they concluded. With this moral principle - taxation based on ability to pay - the Athenians invented democracy.

Every leading world philosopher from Aristotle and Plato to Adam Smith and Karl Marx, the fathers of capitalism and communism, has embraced the Athenian insight. Only in the past third of a century, in America, have these time-tested ideas been forgotten.

Today our airwaves, especially talk radio, are rich with denunciations of our supposedly progressive income tax, in which those who make the most pay the highest rates. Politicians who call themselves conservatives denounce the idea that those who make the most should bear a disproportionate burden.

Read the Full Article